Extend your runway, cheap money is over

How do you survive a cash crunch? Most startup leaders are asking this question right now.

Many smart people are writing about the macro trends. I spoke with founders, angels, and VCs and compiled some practical advice.

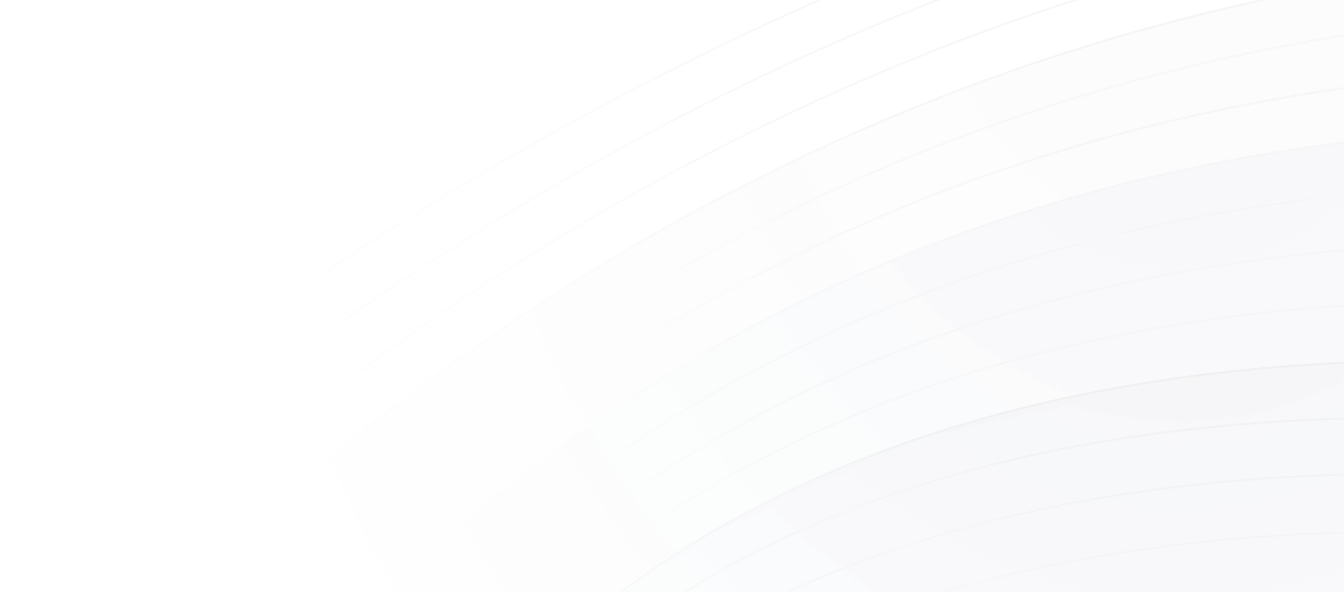

Private markets are reverting to the mean

The wild 2020-2021 ride of startups raising at 100x multiples is coming to a stop. The private market is no longer flush with printed cash, and venture firms are pulling back.

Raising will be harder

Congrats if you managed to raise recently. If you are raising right now, you should wrap it up. Nobody knows how long it will take for the market to be founder-friendly again, but it could be a while.

explaining to LPs why I invested in so many pre-revenue series Bs last year pic.twitter.com/sMUDthykuN

— Turner Novak 🍌🧢 (@TurnerNovak) May 15, 2022

You might think the best VCs always invest in good companies anyway. This is true, but venture funds ultimately answer to LPs. Fundraising is a marketplace, and investors aren't charities.

If the supply becomes constrained, investors will use the leverage to lower prices and negotiate better terms. Hot rounds and pre-emptions will become less common.

Make your runway last

The common advice is to raise enough to last 18 months. If you have less than 12, you have to start raising. If you have less than six, you need to stop whatever you're doing, slash expenses and get more revenue. But if you have more than 18-24, you're sacrificing growth by underspending, the advice goes.

| Runway | How it's going |

| <2 months | ☠️ |

| 2-6 months | Survive at all costs |

| 6-12 months | Raise soon |

| 12-18 months | OK |

| 18-30 months | Good |

| 30+ months | Own your destiny Careful not to lose market share or get lazy |

The 18-month number has an important assumption baked in – that you'll be able to raise again if you get to your next stage (in ARR, GMV, whatever your core metric is).

It might be more prudent to shoot for 2-3 years in times like these.

The actual target will depend largely on the particulars of your business. That said, it's always a good idea to push towards more runway. There are two ways to do it – make more revenue or slash expenses.

Increase revenue with urgency

A while back, Calvin French-Owen asked me a question that has been ringing in my head ever since.

What would you do to get to $xM ARR in 6 months if your life depended on it?

This is closer to reality than you think. Your company's life depends on it.

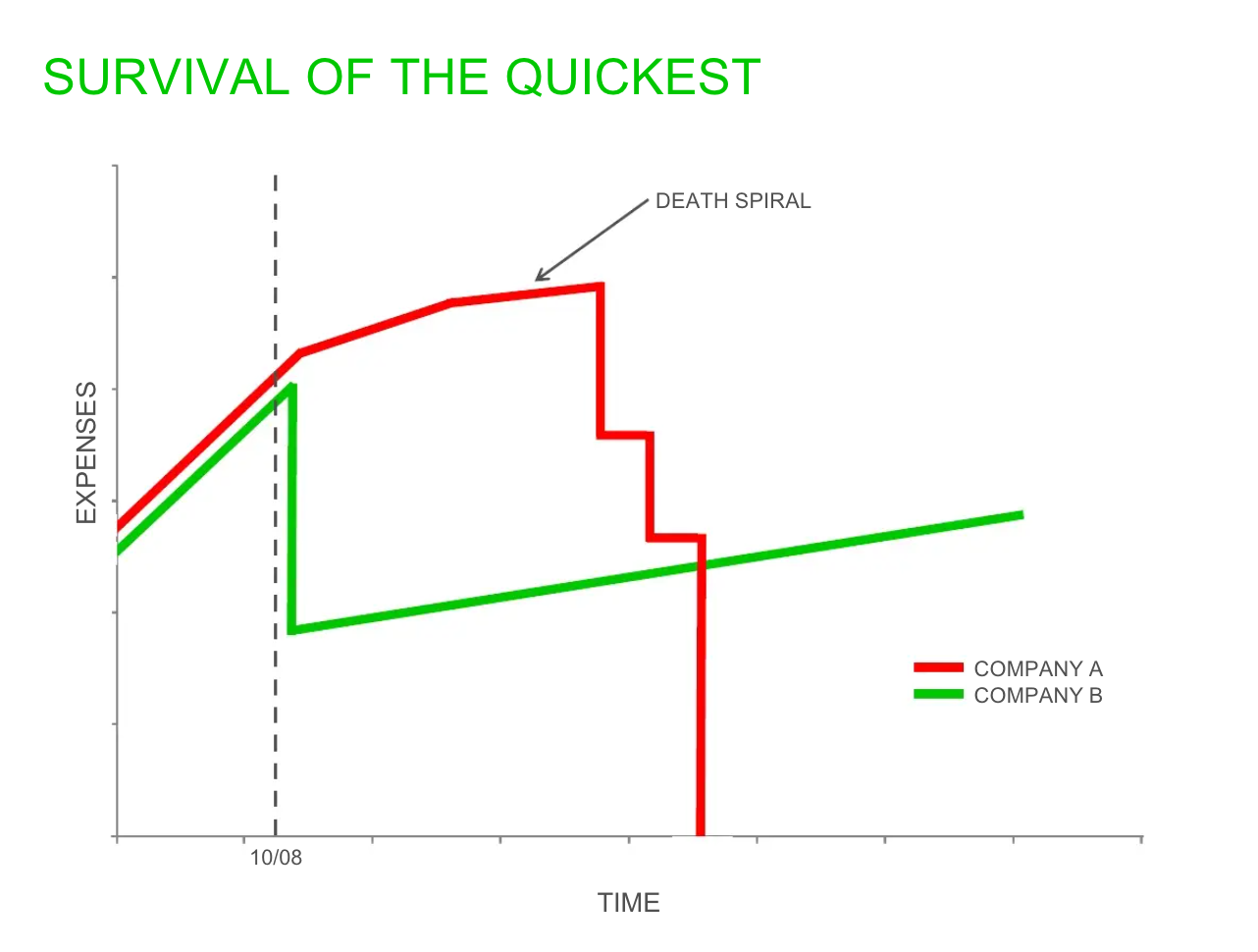

Growth is king

Let's look at a hypothetical seed-stage startup with $2M in the bank right now. It makes $10k a month and spends $100k a month.

- Scenario 1: 0% growth. Dead in 24 months.

- Scenario 2: 5% growth. Dead in 27 months, an improvement

- Scenario 3: 10% growth. Default alive.

If your runway is in trouble, get obsessed with making this number go up. Make the product amazing, go to your customers' offices, do crazy things that don't scale, whatever it takes.

One way to hack this is to improve retention. More revenue without spending on CAC.

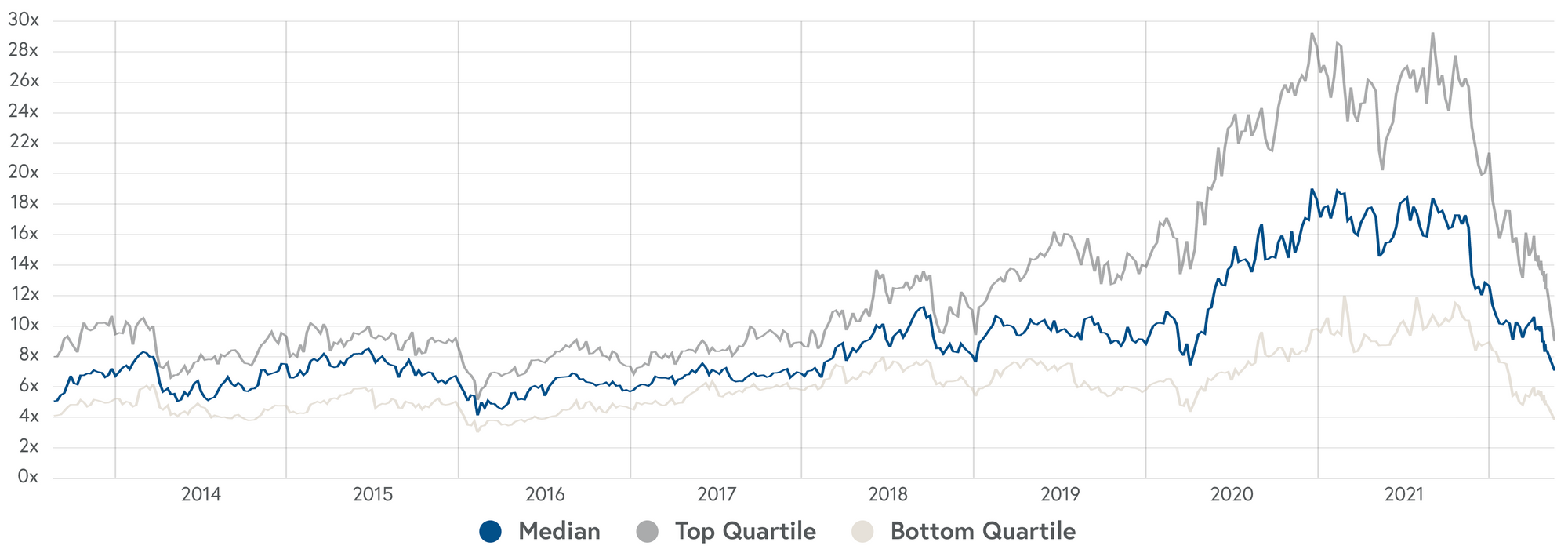

Slash costs decisively

What if you try everything, but you still can't grow revenue fast enough? You have to cut.

Most startups accrue recurring expenses that aren't strictly necessary. It's irresistible after raising a bunch of money (I don't care how disciplined you are).

Take stock of what you're spending (hopefully, you're already doing this every month!), and ✂️ away.

Waiting will cost you. Take a similar company with less cash ($1M), spending $100k a month, with 5% MoM growth.

- No cuts: out of money in 12 months

- Cut 20% now: 16 months

- Cut 30% now: 20 months

Do it now

Duh, spending less gets you more time. Interestingly though, it really matters how soon you act.

- Cut 20% now: 16 months

- Cut 20% in 6 months: 14 months

Waiting six months means you wasted two months.

If you wait eight months, you have to cut 40% to get the same effect as having cut 20% immediately:

- Cut 20% now: 16 months

- Cut 40% in 8 months: 16 months

Waiting just cost you one team member.

Look at your metrics often

I look at our key metrics every week and send a runway report to the entire team every month. I can't recommend this enough. It forces you to confront reality, and lets you notice and fix problems early.

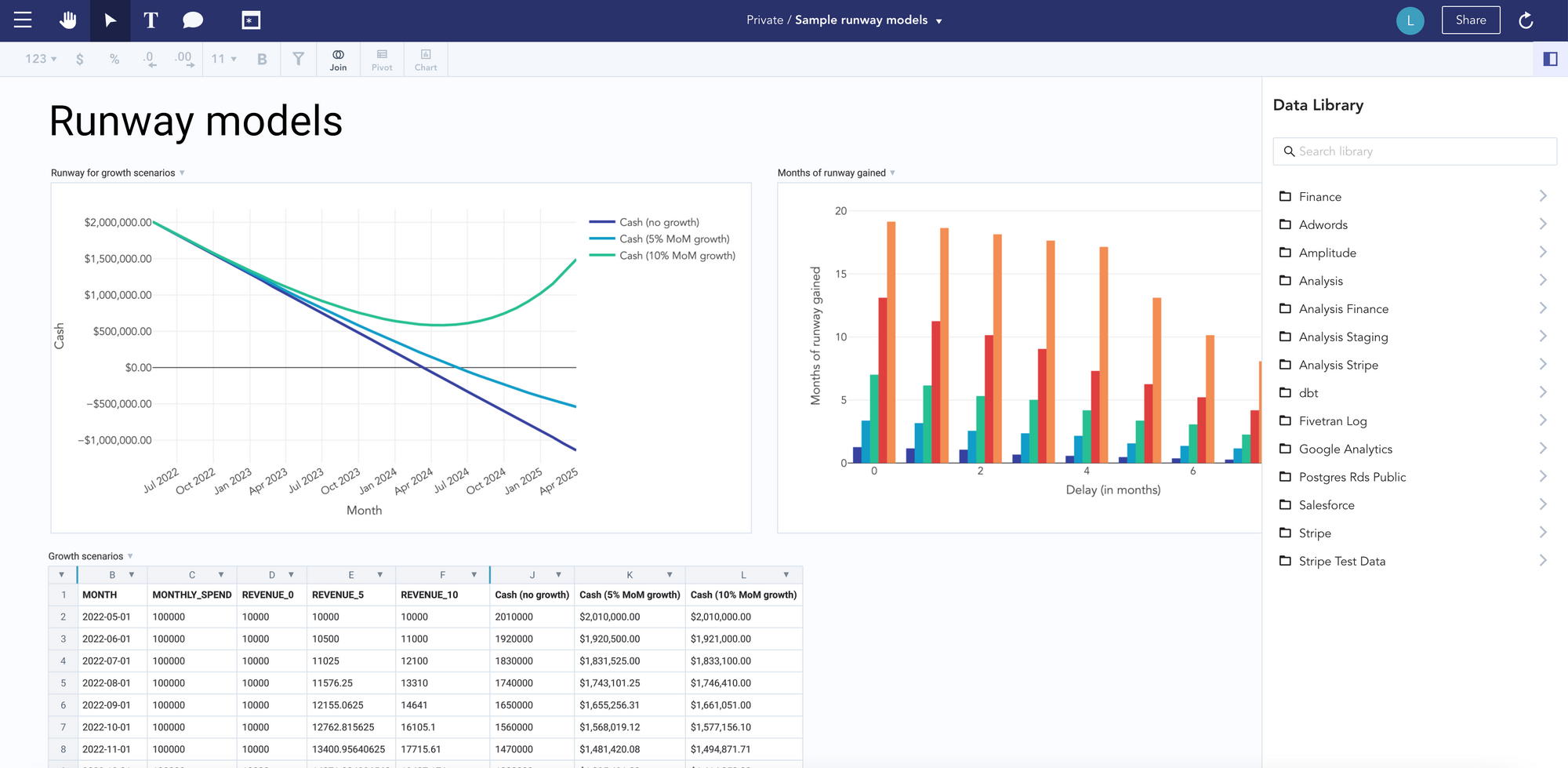

Now for the plug

Disclaimer: I work at Canvas. With Canvas, you can build, track, share metrics without SQL in hours, not weeks. You don't need a data stack to get started – just connect your apps.

Sign up and easily connect all your data sources. You can also try a sample canvas with out-of-the-box Stripe models. Get in touch if you want to start measuring your business like a pro.

Thanks to Konstantine Buhler, Calvin French-Owen, Turner Novak, Ryan Chan, Julian Shapiro, Nick Raushenbush, and Ryan Buick for help with this article.

Discuss on Twitter:

Cheap cash is over. What's happening? How do you survive this?https://t.co/mO3dfjheCO

— Luke Zapart (@lukezapart) May 19, 2022