Growth Marketing Metrics

In this post, we'll walk you through the critical metrics you should be measuring throughout your startup growth stages and show you how to calculate each metric.

Why use growth marketing metrics?

Growth marketing metrics are critical to achieving your budding startup’s goals. First, they go beyond traditional marketing benchmarks, assessing more than brand awareness and customer acquisition to include activation, retention, revenue, and referral.

Also, as a typical startup, you may not have the resources to wait it out as long as more mature establishments with deeper pockets can. Growth marketing metrics can help you harness the power of data to see massive results in a relatively shorter time. These metrics can boost your startup growth by helping you:

- find out which products generate the most revenue growth

- identify channels with the most growth potential

- pinpoint which high-value cohort (a group of people who share a common characteristic for a specific period) you should tap

- assess the campaigns that deliver the best ROI

- determine how many lapsed or inactive customers you have

- evaluate how strong or how weak your business is in general

Now let’s dive into some of the most crucial metrics that drive your startup growth.

Growth Marketing Metrics for Your Startup

1. Net Burn Rate

Your net burn rate is how much money you’re “burning” or losing each month from your capital before your business has a positive cash flow. This information is essential, particularly at the early startup growth stages when funds can be limited.

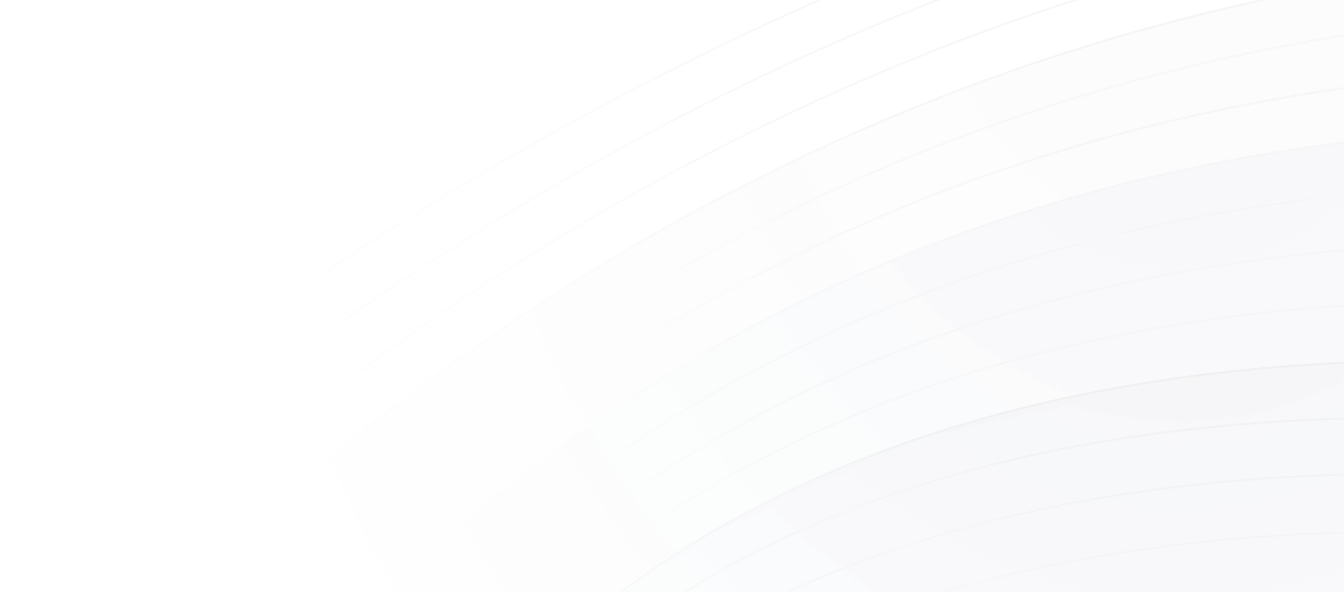

To calculate your net burn rate, deduct your ending balance from your starting balance, then divide the result by the number of months you’ve spent. You can have a negative net burn rate, which means you’re building up your cash reserves, or a positive net burn rate, which tells you that you’re spending more than you should.

FORMULA:

SAMPLE VARIABLES:

Starting Cash Balance: $2,500,000.00

Ending Cash Balance: $2,700,000.00

No. of months: 6

COMPUTATION: ($2,700,000.00 ‒ $2,500,000.00)/ 6 = $33,333.33 per month

MEANING: You are losing $33,333.33 monthly.

2. Startup Runway (or Cash Runway)

This metric will tell you how long your money will last before you need to wave the white or red flag, so you’ll know if you need to cut back on expenses, find ways to raise funding, or rethink your sales campaigns or business model. According to JPMorgan, the ideal startup runway should be 12 to 18 months.

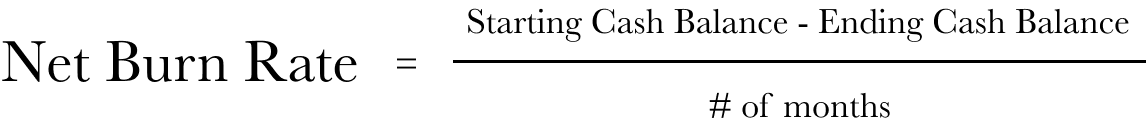

To calculate your runway, take your net burn rate (see above metric), then divide your current cash balance by your net burn rate. Your current cash balance is the amount you have on hand. If you have a cash surplus or a deficit from last month, add or subtract it to your current month’s balance.

FORMULA:

SAMPLE VARIABLES:

Current Cash Balance: $1,800,000

Net Burn Rate: $33,333.33/ month

COMPUTATION: $1,800,000/ $33,333.33 = 54 months

MEANING: You have a healthy startup runway of 54 months which is ample time (vis a vis the ideal 12 to 18 months) to get you through until the next round of funding.

3. Qualified Lead Velocity Rate (LVR)

Lead velocity rate measures the real-time growth of qualified leads month on month (you can also compare longer periods and reference the past year’s performance). This metric is different from sales velocity, which measures how fast leads convert into customers. Many consider LVR a more valuable metric than sales velocity, especially SaaS sales teams, because it’s less affected by seasonality and can be a more accurate predictor of future revenue.

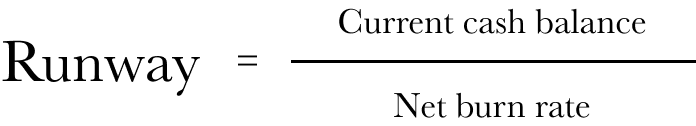

Calculate your LVR by subtracting the previous month’s number of qualified leads from the current month’s number of qualified leads, divide the result by the former, then multiply by 100.

FORMULA:

SAMPLE VARIABLES:

No. of qualified leads from the current month: 125

No. of qualified leads from the previous month: 75

COMPUTATION: ((125-75)/ 75) x 100 = 66.67%

MEANING: Your qualified leads this month grew by about 67% over last month, indicating that your company is using its sales and marketing resources well.

4. Customer Acquisition Cost (CAC)

The CAC metric tells you how much a company spends to win a customer. By comparing this to the actual number of customers it attracts, a company can determine its profitability and how effective its marketing efforts are.

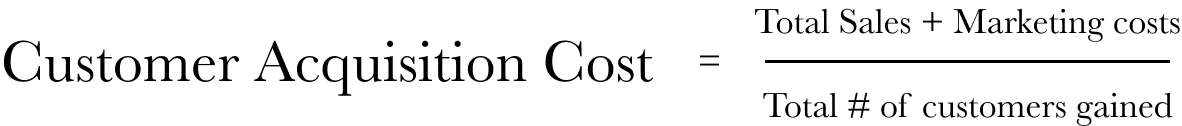

Calculate your CAC by getting your total sales and marketing costs ( including the cost of goods sold and labor) and divide it by the number of customers you’ve gained.

FORMULA:

SAMPLE VARIABLES:

Total Sales + Marketing Costs: $100

Total No. of Customers: 15

COMPUTATION: $100/15 = $6.67

MEANING: On average, it costs you $6.67 to acquire one customer.

5. Activation Rate

This metric gives you the rate at which new customers become active customers (those who’ve taken specific actions to get more value from your product or service). The higher the activation rate is, the bigger the opportunity for them to experience and appreciate the features and benefits of your offer, and the likelier they are to come back and re-purchase or re-use. Some examples of key actions are visiting your website, contacting your customer service, or shopping at your online store.

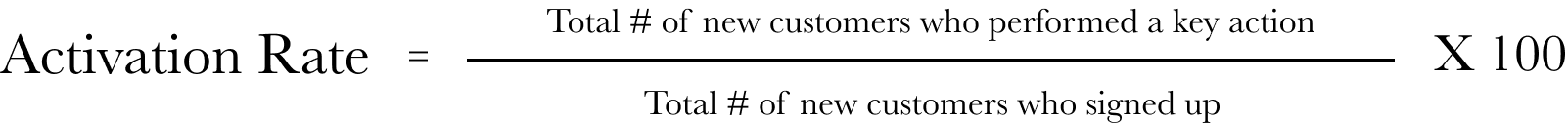

Calculate your activation rate by dividing the number of new customers who performed a specific activity by the number of new customers who signed up for your offer. Then multiply by 100.

FORMULA:

SAMPLE VARIABLES:

Key action: Using a free trial after they’ve signed up

Total no. of new customers who performed the critical action: 50

Total no. of new customers who signed up: 100

COMPUTATION: 50/100 = 50%

MEANING: Out of those who signed up for your marketing campaign, only 50% have become active customers.

6. Customer Retention Rate

This metric shows how many customers your company can manage to keep for a given period. It is critical in driving repeat sales and deriving continuous value from your customer base.

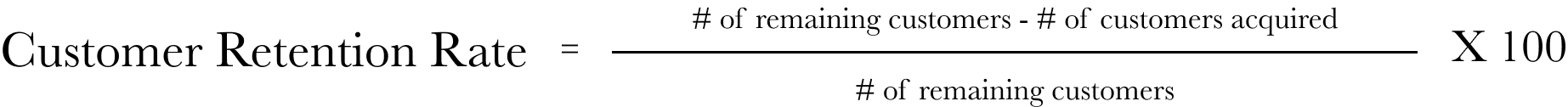

Calculate your customer retention rate by subtracting the number of acquired customers over a given period from the remaining customers at the end of that period. Divide the result by the number of customers at the start of that same period, then multiply by 100.

FORMULA:

SAMPLE VARIABLES:

No. of remaining customers at the end of a period: 90

No. of acquired customers over the same period: 20

No. of customers at the start of the same period: 100

Computation: ((90-20)/100) x 100 = 70%

MEANING: You retain 70% of your customers for a given period. According to some sources, over a 35% retention rate is considered exceptional for SaaS and e-commerce companies.

7. Annual Recurring Revenue (ARR)

This growth marketing metric measures the amount of predictable recurring revenues you can expect in a calendar year, such as from multiple contracts or subscriptions. The stability of this metric can help you project your business’ future revenue to forecast your cash flows better.

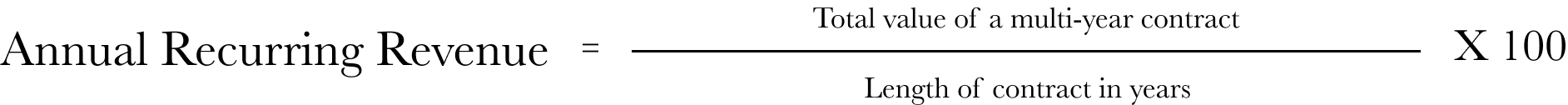

Calculate your ARR by dividing the total value of a multiple-year contract or subscription by its length in years.

FORMULA:

SAMPLE VARIABLES:

Total value of a five-year contract: $7,500

Length of contract in years: 5

COMPUTATION: $7,500/ 5 = $1,500

MEANING: Your expected repeat business of $1,500 per year can help you calculate your total revenue and plan your budget accordingly.

8. Churn Rate

Your churn rate shows the number of customers or users who have stopped doing business with your company over a set time. For example, this rate considers customers who have not renewed their subscriptions or have dropped your products from their shopping list. A high churn rate may indicate a decline in product quality or that the value of your offer is no longer relevant to the needs of your customers.

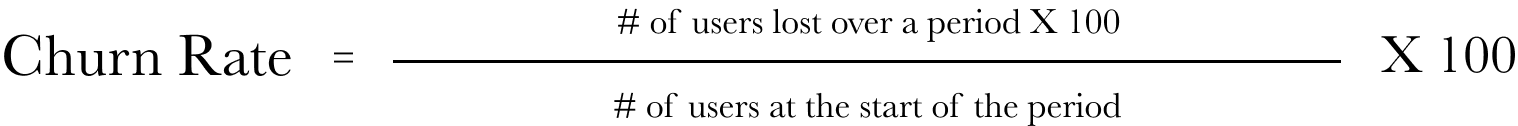

Calculate your churn rate by dividing the number of users you’ve lost over a period by the number of users you had at the start of the period. Then multiply by 100.

FORMULA:

SAMPLE VARIABLES:

No. of users lost over a month: 100

No. of users you had at the start of the month: 1,000

COMPUTATION: (100/ 1,000) x 100 = 10%

MEANING: This means you’re losing customers at a rate of 10% monthly, which isn’t good, especially if you’re a SaaS company targeting SMEs. You may want to bring this figure down to at least 3% to 5%.

The Bottom Line

These key growth marketing metrics can help drive your startup growth by helping you quantify your performance, fine-tune your strategies, and achieve your targets at each stage of the marketing funnel.

At Canvas, we help operators use real-time data to build and share metrics like these without SQL. Our spreadsheet-like interface lets you centralize, combine, and analyze data from your warehouse or any app in minutes. You can get started here for free or request a demo at hello@canvasapp.com.